maricopa county tax lien foreclosure process

Learn to buy tax liens in Maricopa County AZ today. FILL OUT THE NOTICE OF INTENT TO FILE FOR FORECLOSURE.

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

The first step is to send a 30 day demand letter that meets.

. It shall remain posted for at least 2 weeks before the start date of the Tax Lien Sale. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. All groups and messages.

The initial step is for the IRS or local tax agency to decide that a person truly owes back. What is the process to foreclose my tax lien. Free and simple bulk payment solution for Mortgage Companies Tax Servicing Companies Developers and other multi-account payers.

The County Treasurer shall post a list of the delinquent taxes in the office lobby. Coconino County 219 East Cherry Avenue Flagstaff AZ 86001 Phone. The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple.

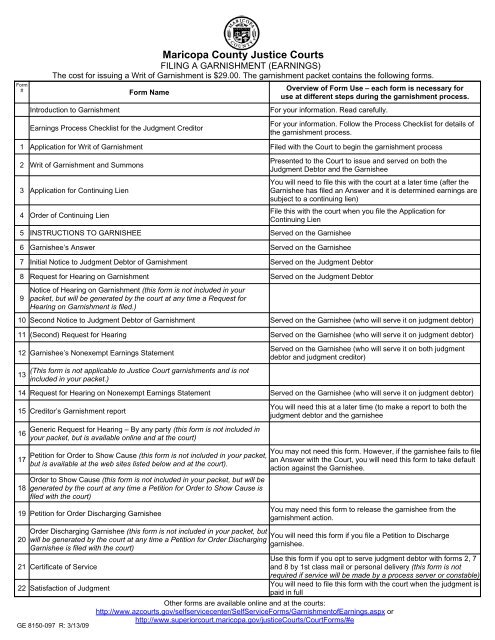

To obtain the deed on your tax lien certificate you must follow a three step process. The instructions and forms are also. Corporate Services Bulk Payers.

Setup email alerts today. You will also need a Civil Cover Sheet. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale.

Maricopa County AZ. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order certified. The Tax Lien Sale will be held on February 9.

How do I check for Tax Liens and how do I buy Tax Liens in Maricopa County AZ. Tax Lien Foreclosure Home Practice Areas Tax Lien Foreclosure Tax Lien Foreclosure Contact us Please fill out the form. After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property.

Maricopa County AZ currently has 18422 tax liens available as of October 26. County Court House 415 E. Be the first to know about new foreclosures in an area.

Spring St Kingman AZ. Back to top We in the Treasurers Office are happy to be of service. You can reach the Law Library by calling 928-753-0790.

An Action to Foreclose filed in the Superior Court three years from the sale date is the only method to compel payment. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St. Tax Lien Web The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Except Federal Holidays Customer Service. What is the tax deed process. Phoenix Law Firm Baumann Doyle Paytas Bernstein P.

Instructions and forms for filing an out-of-state or foreign judgment are available on the Clerks Forms page. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. There are currently 11375 tax lien-related investment opportunities.

In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest.

What Really Happens At The Maricopa County Public Auction Arizona Bargain Homes Weblog

Arizona Officials Detail Plan For Public Safety During Election 12news Com

Free Arizona Power Of Attorney Forms Pdf Word

How To Buy Tax Liens In Maricopa County Youtube

Fill Free Fillable Forms Maricopa County Telecommunications

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Az Quit Claim Deed Form Fill Out And Sign Printable Pdf Template Signnow

Disabled Veteran Property Tax Exemptions By State And Disability Rating

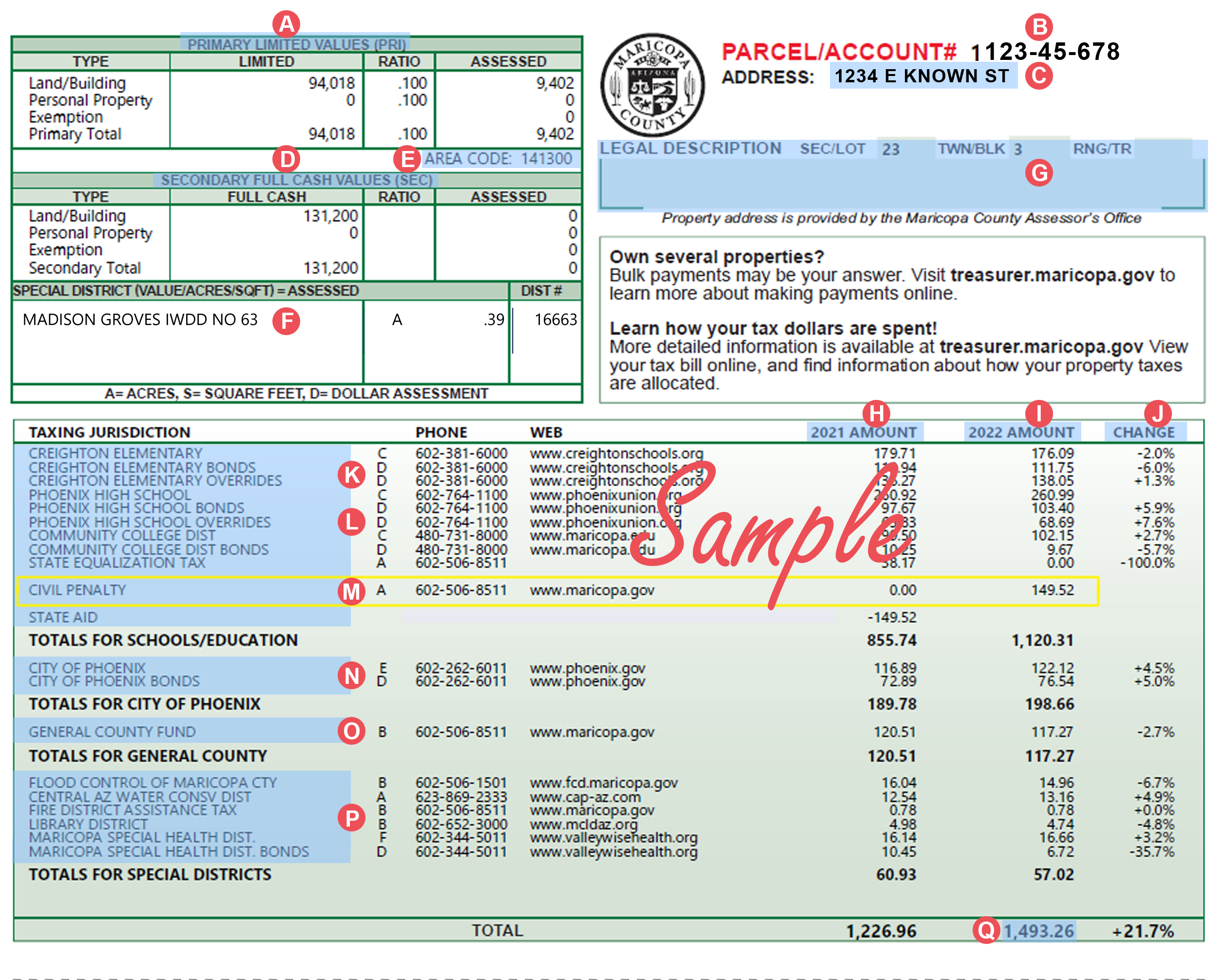

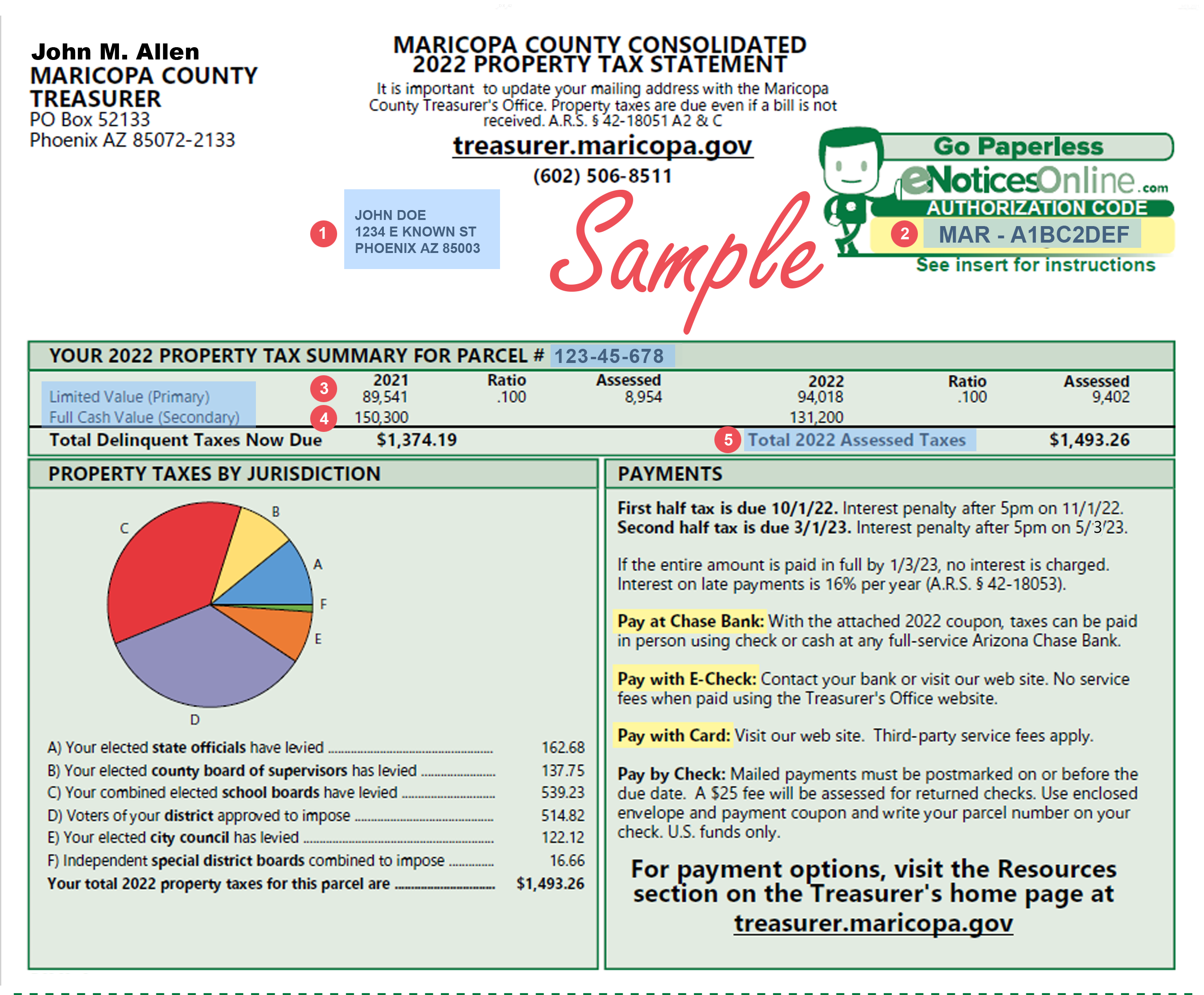

Maricopa County Assessor S Office

Bailed Out Banks Snap Up Tax Liens

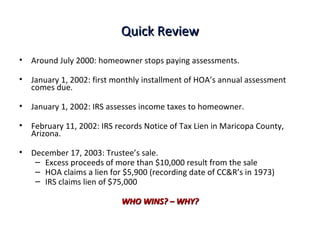

Hoa And Irs Lien Priority Issues

Property Taxes In Arizona Lexology

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Maricopa County Preliminary Notice Of Mechanics Lien Form Arizona Deeds Com

Fillable Online Quit Claim Deed Maricopa County Fill Online Printable Fillable Fax Email Print Pdffiller